What’s going on with New York’s Excluded Workers Fund?

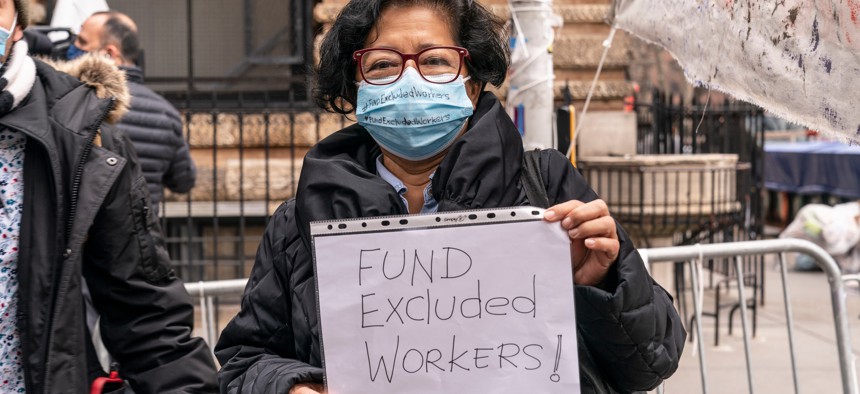

People rallying in support of the Excluded Workers Fund in March. lev radin / Shutterstock

New York state established a $2.1 billion Excluded Workers Fund in April to provide financial relief to undocumented immigrants who have otherwise been able to benefit from federal COVID-19 aid. But people who are preparing to apply for support through the fund are struggling to get the needed documentation in place, Documented reports.

Applicants will be able to provide various documents for identification, proof of lost income and proof of residency, but getting access to such documentation has proven difficult. Processing times for Individual Taxpayer Identification Number have tripled, for example, and some employers have been reluctant to provide letters of employment fear facing scrutiny for hiring undocumented workers.

New York state is hoping to lean on nonprofits to make the application process less strenuous for people seeking aid and to promote the fund’s existence. The state Department of Labor is committing $10 million to fund organizations that can help undocumented immigrants get help through the Excluded Workers Fund once applications begin to be accepted.

Recipients, who must have earned no more than $26,800 last year, can get direct payments if selected. One tier of recipients will get up to $15,600, with $780 deducted in taxes, while others may qualify to receive $3,200, with a $160 deduction